EV success isn’t about who’s most innovative — it’s about who understands local wallets, habits, and biases better.

Unpacking 2023 EV Market Performance: Insights on Brands, Buyers, and Regional Dynamics

- May 1, 2025

- By Sagarika Chikhale

The global electric vehicle (EV) market in 2023 reflected a dynamic and fragmented landscape shaped by regional preferences, brand positioning, and shifting consumer priorities. This analysis explores key trends in EV sales performance across different brands, customer segments, and continents, uncovering patterns in revenue generation, fast-charging adoption, vehicle type preferences, and demographic behaviors. From Kia’s global dominance to Tesla’s premium pricing paradox, and from BMW’s appeal to tech-savvy buyers to regional discrepancies like Europe’s low adoption, the findings highlight the complexity of market drivers. These insights provide a foundation for strategic recommendations to align products, pricing, and policy with evolving global demand.

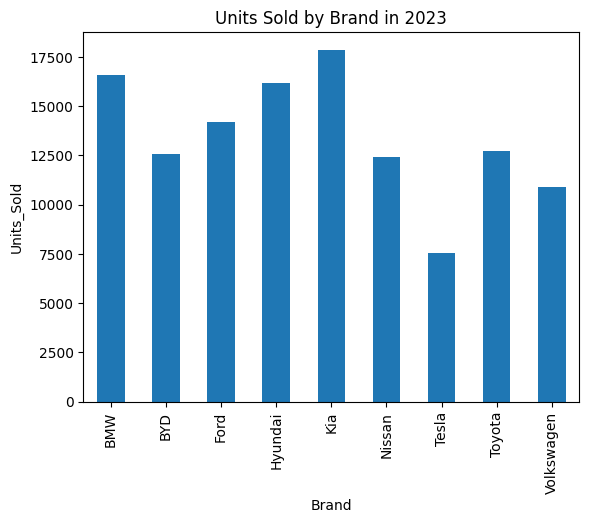

The analysis of brand-wise EV sales in 2023 shows that Kia emerged as the most sold brand globally, followed by BMW, indicating their strong market presence and appeal to a wide range of consumers. Conversely, Tesla recorded the lowest number of units sold among all brands analyzed, which may suggest a shift in consumer preferences or heightened competition in premium EV segments.

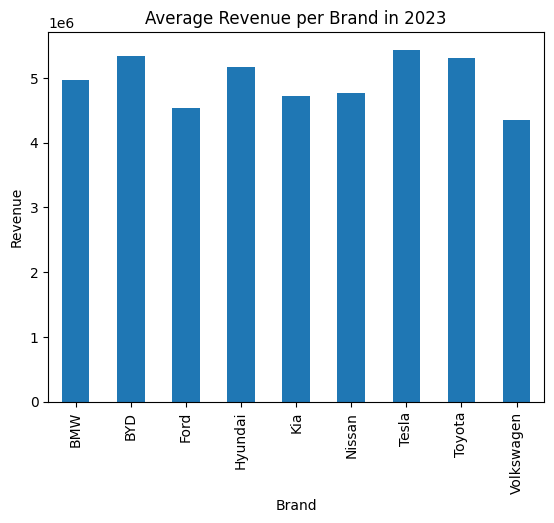

While unit sales offer one perspective, a deeper look into average revenue per brand presents a different picture. Tesla, despite its lower sales volume, generated the highest average revenue per vehicle sold in 2023, followed by Toyota. This indicates that Tesla’s pricing strategy or product positioning continues to command a premium. In contrast, Volkswagen had the lowest average revenue, pointing either to aggressive pricing strategies or a focus on budget-conscious segments.

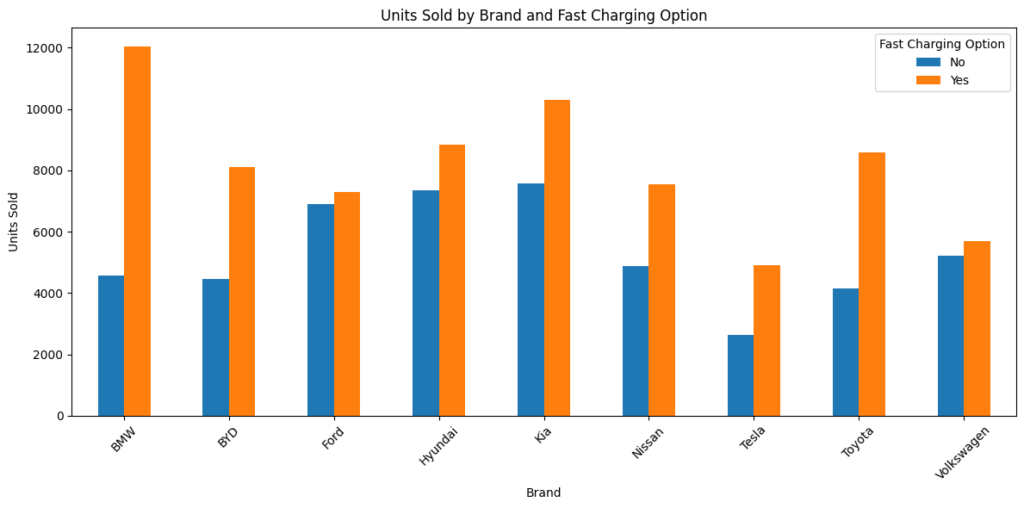

When examining the impact of fast-charging capabilities across brands, the data suggests a strong global preference for EVs equipped with fast-charging technology. Brands that offered fast-charging options saw higher adoption. BMW led in fast-charging EV sales, reflecting its alignment with consumer demand for faster charging times and convenience. Interestingly, Tesla, a brand historically associated with advanced technology, recorded the lowest sales in the fast-charging EV category, which could point toward may be a model-specific gap in offerings.

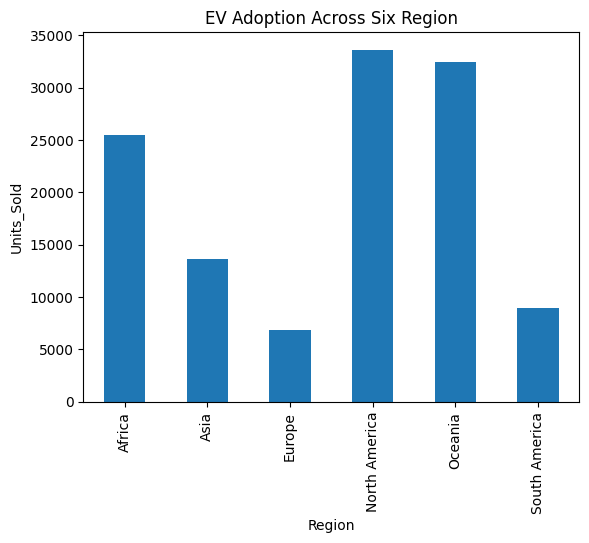

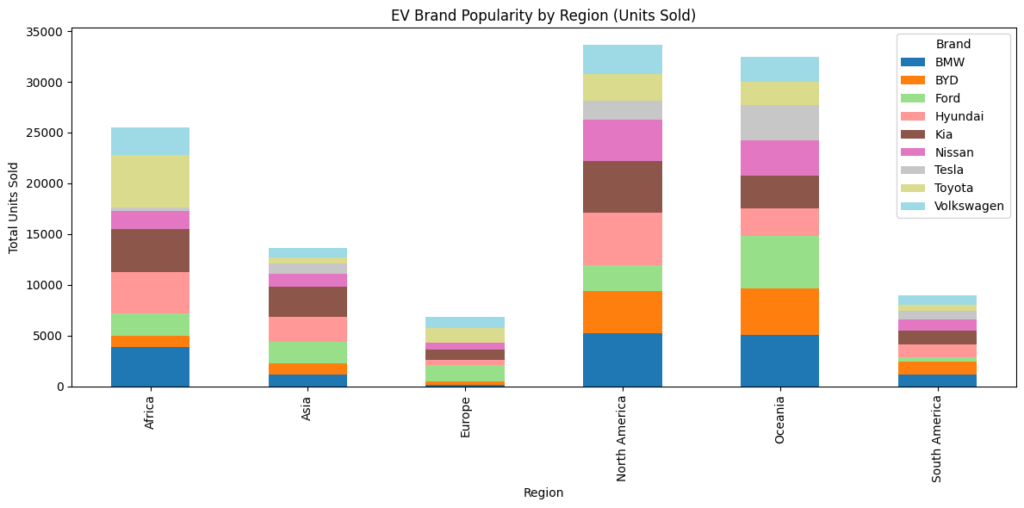

The regional analysis of EV adoption across six continents North America, South America, Europe, Asia, Africa, and Oceania shows notable variation. North America led the world in EV sales during 2023, likely driven by favorable policy environments, higher disposable incomes, and better infrastructure. Oceania followed closely behind, reflecting the region’s rising interest in sustainable transport. Surprisingly, Europe recorded the lowest sales in this dataset, which is atypical of global EV trends. This result may be influenced by regional market saturation, economic challenges, or simply a reflection of the sample dataset.

A cross-analysis of customer segments and brand preference highlights how different demographic or psychographic groups interact with specific EV brands. High Income and Middle Income customers both showed a preference for BMW, suggesting that the brand resonates across a range of financially capable buyers due to its balance of luxury and performance. The Budget-Conscious segment leaned toward Kia, reinforcing the brand’s image as a reliable and affordable option. Among the Tech Enthusiasts, BMW again stood out, possibly due to its adoption of innovative features and strong brand perception in technological advancement. Meanwhile, Eco-Conscious consumers preferred Kia, indicating the brand’s alignment with environmentally focused values and cost-effective sustainability.

The regional breakdown of EV brand popularity in 2023 reveals intriguing variations in consumer preferences across global markets. Toyota emerged as the most popular EV manufacturer in Africa, indicating a strong foothold in developing regions where brand trust and perceived reliability may significantly influence purchase decisions. In contrast, Kia dominated the Asian and South American markets, likely due to its balance of affordability, modern features, and accessibility. Meanwhile, Ford was the leading brand in Europe, a somewhat unexpected outcome given the dominance of local European manufacturers in real-world trends. In North America and Oceania, BMW held the top position, reflecting its strong appeal in high-income regions with mature automotive markets.

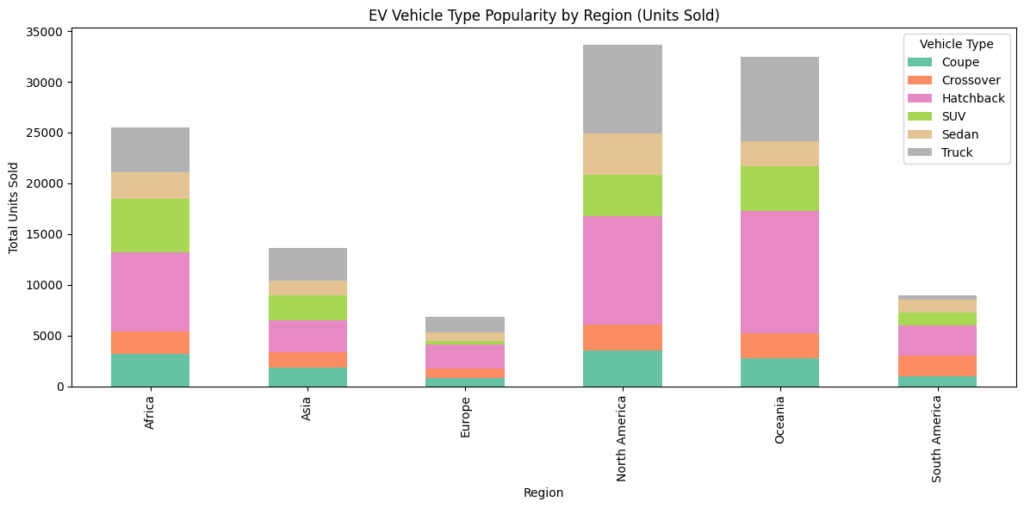

When analyzed by vehicle type, Hatchbacks emerged as the most popular category across five of the six regions: North America, South America, Europe, Oceania, and Africa. This could suggest a general preference for compact, city-friendly, and affordable EVs in these regions. Asia was the only region where Trucks gained more traction, highlighting regional variations in lifestyle and infrastructure that influenced vehicle type preferences.

To understand the factors influencing EV purchase decisions in more depth, we analyzed customer segments within two key regions, North America, which had the highest EV sales, and Europe, which recorded the lowest in 2023.

In North America, High Income consumers most often chose BMW, with weak correlations between sales and both discounts (0.204) and price (-0.256), and almost none with battery capacity (0.016), indicating brand perception likely drove decisions. Middle Income buyers preferred BYD, showing greater sensitivity to discounts (0.266) but minimal influence from battery capacity. Budget Conscious consumers leaned toward Hyundai, yet discounts showed a negative correlation with sales (-0.239), suggesting perceived value outweighed price cuts; battery characteristics and price had only weak positive effects. Tech Enthusiasts also favored BMW, with a stronger emphasis on performance such as battery capacity (0.285) and price (0.49) correlated positively with sales, while discounts had a negative effect (-0.22), highlighting a preference for premium features. Meanwhile, Eco-Conscious consumers opted for Kia, where battery capacity positively influenced purchases (0.246), and both price and discount had minimal impact, underscoring sustainability as a key motivator.

In contrast, Europe, despite being a mature market for EVs—recorded the lowest sales in the dataset. Among High Income buyers, Volkswagen was most popular, though battery capacity and price (-0.411) negatively affected sales, while discounts (0.288) had a moderately positive impact, showing greater sensitivity to promotions. Middle Income consumers preferred Ford, but extreme correlation values (-1.0 and 0.999) across all factors suggest possible data quality issues. Budget Conscious buyers also favored Ford, with strong negative correlations for battery capacity and price (-0.472), and a moderate positive link with discounts (0.36), indicating a preference for affordability. Tech Enthusiasts leaned toward BYD but showed weak sensitivity to battery (0.014), and negative reaction to price (-0.370), suggesting a focus on innovation as well as pricing. Eco-Conscious buyers chose Toyota, though battery, price, and discounts had weak to moderate negative correlations, hinting that values like sustainability and brand ethos mattered more than specs or incentives.

Altogether, these regional and segment-wise insights highlight the complexity of EV purchasing behavior and the multifaceted influences of brand perception, pricing strategies, vehicle attributes, and customer priorities across global markets.

Next Steps:

• Diversify Pricing and Product Strategy Across Regions

Manufacturers should adopt region-specific pricing strategies and product bundles, offering premium features in affluent regions (e.g., North America, Oceania) and value-driven, affordable models in price-sensitive regions (e.g., Europe, Africa).

• Expand Fast Charging Capabilities Across All Models

Invest in fast-charging infrastructure and technology across all price segments, particularly for brands like Tesla and Kia where model-specific gaps were identified, to align with growing consumer demand for convenience.

• Realign Brand Messaging with Target Segments

Strengthen brand positioning and marketing to better resonate with specific demographics e.g., promote innovation and performance to Tech Enthusiasts or sustainability to Eco-Conscious buyers using targeted campaigns.

• Improve Data Accuracy and Integrity in European Market Studies

Audit and enhance data quality for key markets like Europe before deriving strategic conclusions, ensuring future strategies are based on reliable insights.

• Encourage EV Adoption Through Targeted Policy Advocacy

North America’s success in EV sales may stem from favorable policies and infrastructure. Collaborate with policymakers to replicate effective EV adoption policies (e.g., incentives, charging station expansion) in underperforming regions like Europe and Africa.